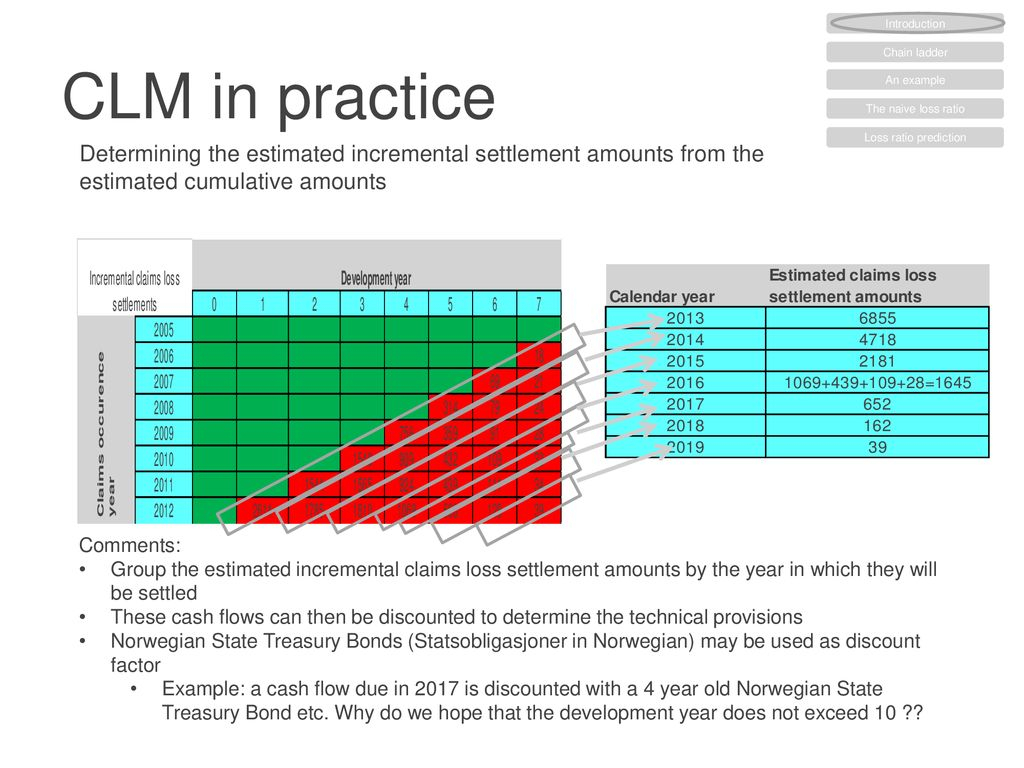

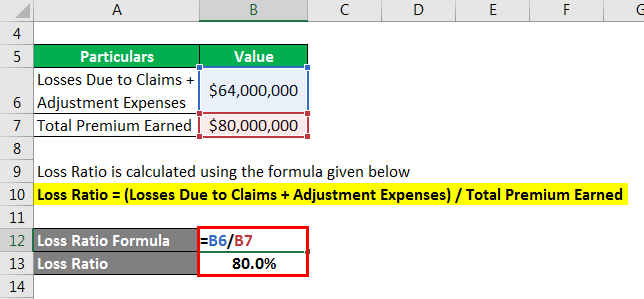

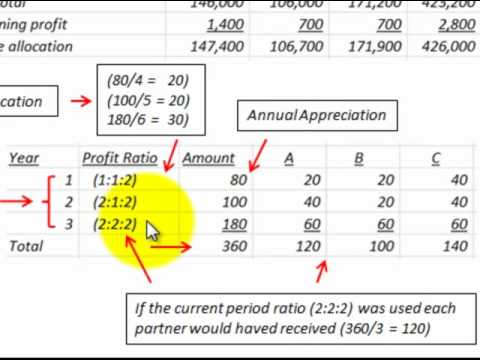

Calendar Year Loss Ratio Formula 2024. They are the standard calendar year loss ratio and the calendar year loss ratio by policy year contribution. When the loss data is summarized in a triangular format, it can be analyzed from three directions: accident year (AY), development year (DY), and payment/calendar year (CY). However, many factors can create dependencies between the three directions and is assumption. The Rate Announcement is released on an annual basis and includes updates to the capitation and risk adjustment. We use ½ because the formula tells us to divide one by the number of years' difference between the two numbers, in. (Accident Year Combined Ratio): Examines a company's accident year underwriting results. Liability lines have seen a steady upward trend in calendar-year loss ratios over the past several years, necessitating rate increases by liability underwriters. Weights on previous accident year's developed loss ratios are set using least squares technique that minimizes the distance between actual and projected loss ratios. CY-AY (Calendar Year Combined Ratio Less Accident Year Combined Ratio): Measures the point impact associated with.

Calendar Year Loss Ratio Formula 2024. Then is the increment of the accident year. Two basic methods exist for calculating calendar year loss ratios. Negative underwriting ratios indicate that the premium collected was not adequate to pay benefits (losses) and expenses. CY-AY (Calendar Year Combined Ratio Less Accident Year Combined Ratio): Measures the point impact associated with. Dates should be entered by using the DATE function, or as results of other formulas or functions. Calendar Year Loss Ratio Formula 2024.

Two basic methods exist for calculating calendar year loss ratios.

Then is the increment of the accident year.

Calendar Year Loss Ratio Formula 2024. According to the ASTIN report on non-life reserving [] only chain ladder and Bornhuetter-Ferguson are more widely used. ⋯ ∈ ⋯ denote the incremental claims of (payments or incurred amounts). Weights on previous accident year's developed loss ratios are set using least squares technique that minimizes the distance between actual and projected loss ratios. Negative underwriting ratios indicate that the premium collected was not adequate to pay benefits (losses) and expenses. Accident Year Experience: Premiums earned and losses incurred during a specific period of time. CY-AY (Calendar Year Combined Ratio Less Accident Year Combined Ratio): Measures the point impact associated with.

Calendar Year Loss Ratio Formula 2024.