What Is A Calendar Spread 2024. Definition and Examples of Calendar Spread A calendar spread is an options or futures strategy established by concurrently entering a protracted and short position on the identical underlying asset but with different delivery dates. A calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and selling a derivative of the same asset in another month. A calendar spread is an option or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with different delivery dates. Calendar spreads are also known as 'time spreads', 'counter spreads' and 'horizontal spreads'. A calendar spread is a strategy used in options and futures trading: two positions are opened at the same time – one long, and the other short. In a typical calendar spread, one would buy a longer-term contract and go short a nearer-term option with the identical strike price. The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time, with limited risk in either direction. The goal is to profit from a neutral or directional stock price move to the strike price of the calendar spread with.

What Is A Calendar Spread 2024. The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time, with limited risk in either direction. Definition A calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike price, but for slightly different expiration dates. Each month of the year is on a separate worksheet. This thoughtfully designed dog-themed cover academic planner is the key to staying organized, and focused, streamlining your daily schoolwork, and assisting you in succeeding throughout the academic year. These templates are theme-enabled, so you can modify the fonts and colors easily. What Is A Calendar Spread 2024.

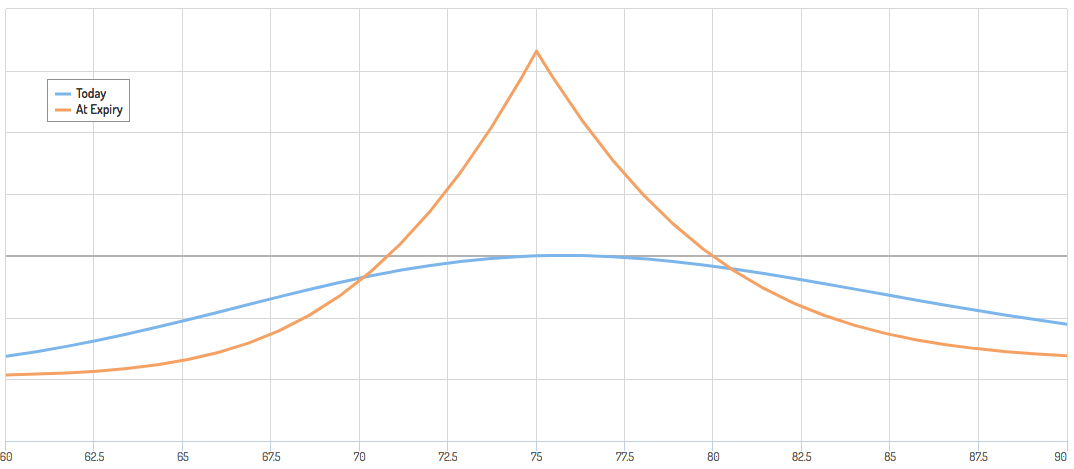

The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time, with limited risk in either direction.

Definition A calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative contract at the same time and same strike price, but for slightly different expiration dates.

What Is A Calendar Spread 2024. Futures trading is a very volatile activity. Calendar spreads are also known as 'time spreads', 'counter spreads' and 'horizontal spreads'. It may happen that a calendar does not properly fit the page when printed. A calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but with different delivery dates. In such case, look for a "Fit to page" or "Reduce/Enlarge" option in your printer's preferences dialog.

What Is A Calendar Spread 2024.