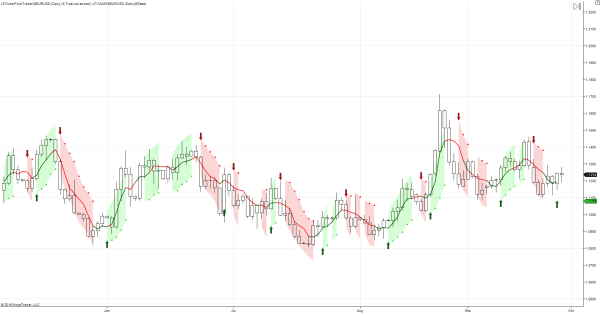

Futures Calendar Spread Arbitrage 2024. The most important difference between the two types of underliers is the term structure. The first term we have just argued is non-negative, the second is strictly positive. The Futures price reflects the market sentiment of the subject's price. According to the theory of calendar spread arbitrage, we proposed a strategy which is effective in practice. Calendar spread traders are primarily focused on changes in the relationship between the two contract months; the goal of this strategy is to take advantage of those changes. Do similar criteria exist for European options on futures? How to use contango and backwardation for arbitrage trading Contango is a price premium. In most cases, there will be a loss in.

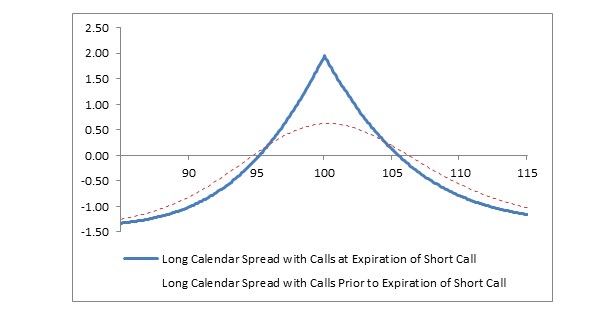

Futures Calendar Spread Arbitrage 2024. Covered Calls Naked Puts Bull Call Debit Spreads Bear Call Credit Spreads Bear Put Debit Spreads Bull Put. In a calendar spread, we attempt to extract and profit from the spread created between two futures contracts of the same underlying but with different expiries. The basic arbitrage relationship can be derived fairly easily for futures contracts on any asset, by estimating the cashflows on two strategies that deliver the same end result – the ownership of the asset at a fixed price in the future. In order to explain the idea, we will have to dig a bit into the theory and mathematical formulas. To maintain a long position in Treasury futures, one could sell the calendar spread, which simultaneously sells the nearby delivery month (to offset the existing long position to zero) and buys the deferred delivery month (re-establishing the long. Futures Calendar Spread Arbitrage 2024.

The Futures price reflects the market sentiment of the subject's price.

Electricity prices in Alberta in July more than doubled from a year earlier, climbing to a record high and diverging the most ever from the Canadian average in data stretching back four decades.

Futures Calendar Spread Arbitrage 2024. Recall the margin (initial and maintenance) formula. According to the theory of calendar spread arbitrage, we proposed a strategy which is effective in practice. The options are both calls or puts, have the same strike price and the same contract. Covered Calls Naked Puts Bull Call Debit Spreads Bear Call Credit Spreads Bear Put Debit Spreads Bull Put. The calendar spread is a simple extension of the cash & carry arbitrage.

Futures Calendar Spread Arbitrage 2024.